In this ‘digital trends around the world’ series, I’m sharing fascinating and useful insights into the world’s digital landscape, including how and why it’s evolved differently for different audiences and what this means for your business if you’re expanding to different international markets.

After exploring China, Indonesia and Brazil, we now swing to the Middle East, to focus on the United Arab Emirates (UAE).

A federation of seven emirates, the UAE is one of the 19 countries of the MENA (Middle East and North Africa) region* and the world’s twenty-ninth largest economy. Its population is currently about 9.2 million, of which about 13 percent is UAE nationals. As a global commercial and financial hub, the UAE has the world’s largest ex-patriot population, the largest percentage being South Asians.

If you’re considering the UAE for new business horizons or if you’re in the marketing or digital design space, this is a useful ‘toe dip in the water’ of the specific characteristics and digital behaviours of your intended target market group within the UAE’s diverse, shifting and often hard-to-pin-down overall demographic.

Although the UAE has been heavily impacted by weaker energy prices, in 2015 it ranked #4 on Bloomberg Markets’ annual ranking of the most promising emerging nations in which to invest.

Be’ati Watani, an Arabic-English online educational resource, is the first environmental education program for children devoted specifically to the UAE environment.

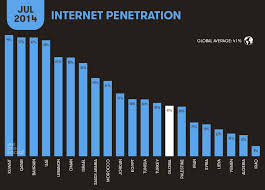

The UAE has positioned itself as a regional technology leader by offering fast, if relatively expensive (ranked 55th globally for affordability) internet. UAE household internet penetration is the 3rd highest in the region (behind Qatar and Bahrain) and 10th globally. This growth has been spurred by good infrastructure and factors like users’ early adoption of cloud computing.

Internet in the UAE and the growth of mobile technology have opened up mass communication access and swelling growth in e-commerce. This has been supported by the UAE government’s investment in digital technology through its eGovernment program to diversify the economy and improve the UAE’s competitiveness.

MENA region internet penetration: 94% penetration in UAE (41% globally).

The UAE government and business have also been leveraging digital technology to facilitate, improve and accelerate product and service delivery and create new business opportunities, especially in the growth sectors of the aviation industry , aerospace manufacturing, hospitality (especially for major sporting events and exhibitions), finance, retail (particularly in luxury goods) and real estate.

MyID, part of the UAE’s Smart Government initiative, allows users access to all government e-services through one login via any digital device.

With a populace that eagerly embraces ‘newness’, including the latest in digital technology, online activity in the UAE is already one of the highest in the world. Adults in the UAE own at least four devices each, bringing the UAE in line with the global average, according to a recent Connected Life study by global market researcher TNS.

In 2015, UAE internet users were found to spend 5 hours a day on average using PCs or laptops, and 3 hours on mobile devices, placing them at #6 globally.

New Twitter customer service portal for UAE-based telco Etisalat. Derived from اتصالات or ittiṣālāt, Etisalat means ‘communication’. It’s the 12th largest mobile network provider, operating across the Middle East, Asia and Africa.

TNS found that smartphone device ownership in the UAE is over-indexed, which means consumers own more smartphones compared with the rest of the world, makng it the global leader in the smartphone market, both overall and in terms of density.The study also revealed that UAE residents are fast to follow digital trends. In fact, the UAE now ranks ahead of many ‘mature’ digital markets, particularly when it comes to device-driven services.

UAE consumers, according to TNS’ Middle East CEO Stephen Hillebrand, are ‘very open to using mobile devices to support lifestyle (and) monitoring personal data like exercise, connecting the car or home to other devices or the internet, using a 3D printer, and even using wearable technology, such as smart watches.’ These device-driven trends are opening opportunities for flexible entrepreneurs with very specific markets in mind.

Among UAE mobile users, the most common usage is social media activity, at 52 percent. This is followed by watching videos (45 percent), playing games (33 percent), seeking locations (31 percent) and mobile banking (31 percent).

While e-commerce in the UAE still has some way to go, the UAE is the MENA leader in B2C e-commerce growth. From a base of the region’s best e-commerce infrastructure and with its highest mobile, smartphone, internet and payment card penetration, e-retail sales in the UAE are expected to triple between 2014 and 2019.

One of UAE’s two major e-commerce trends is mobile commerce, with one quarter of online shoppers in 2014 making their last online purchase on smartphones. The other major trend is cross-border online shopping, with almost two-thirds of all online shoppers purchasing directly from foreign outlets, led by Amazon, eBay and, regionally, Souq.com, the Arab world’s largest e-commerce website.

PayPal comments that in 2015, among smartphone users globally, 64 percent make purchases using apps, compared with 52 percent who use mobile browsers. The reasons cited are convenience and speed, as well as factors that build consumer trust and confidence like built-in reminders and instant payment confirmation.

This trend provides nimble marketers with a great opportunity to develop targeted communications and include strategies such as app design.

Dubizzle property app for Dubai-based online classified business founded by expats Sim Whatley and J.C. Butler and now dominating the region for classified advertising.

In the UAE, users are also quickly adopting ever more advanced devices and increasingly creating ‘screen stacking’, a multi-screen effect which combines traditional communication devices (newspapers, radio and television) with mobile devices. This phenomenon is creating new challenges to create integrated marketing that attracts consumers and keeps up with their shifting habits.

Consumers are selecting the device, channel or touch-point that’s relevant to them and to the particular moment in time that they’re in. UAE users are heavily influenced by what they see and read on digital and social channels. Hillebrand comments that:

Internet users in the UAE are very active communicators and many are attracting followers across a variety of channels, including direct communications via Instant Messaging, email, and video/voice calls. Facebook and YouTube (are) the top contenders, but it is the new-kid-on-the block, WhatsApp that is emerging as the most favoured communication platform’.

Hanan Abdullah at the University of Wollongong in Dubai, researching social media trends among young Emirati women between 17 and 24 years of age, found that young women are spearheading the screen stacking trend. An average of 92 percent of those surveyed are active across at least three accounts on social media websites.

Founded by Irish entrepreneur Paul Kenny, Cobone is one of the Gulf region’s most used coupon websites.

The UAE has strict regulations prohibiting certain digital content, which you should be aware of when engaging in any way in this digital space. Censorship focuses particularly on government criticism and pornography but also includes:

- content that is considered offensive to Islam

- dating websites

- websites that allow or assist users to access blocked content

- gambling websites, and

- sites with information about purchasing, manufacturing, promoting or using illegal drugs.

If you’re wondering where all the Arabic language websites are, that may be because only Arabic websites are heavily ‘outgunned’ by English and other languages. The online Arabic-speaking population overall now surpasses Russian, French, and German. But despite this and although Arabic is the world’s 5th most spoken language, Arabic web content makes up just 3% of the world’s total web output. This highlights the sharp discrepancy between current market attention and the Arab world’s actual value.

But that clearly hasn’t deterred Arabic digital user activity and the percentage of Arabic language digital content is set to grow exponentially as Arabic website design takes off. Dr. Fayeq Oweis, language services manager at Google for MENA/Africa/Emerging Markets, has reported strong improvement in Arabic content in the past few years. And companies are starting to take seriously the benefits of developing Arabic version websites to reach out to Arabic speaking audiences and satisfy demand for Arabic content. But many companies have taken this step without understanding or planning for the unique characteristics of the Arabic digital environment when it comes to designing, setting up and managing Arabic websites and pages.

Arabic’s right-to-left (RTL) layout makes it one of the most difficult languages to design for digitally. Arabic digital design is particularly complex because the entire web page needs to be flipped horizontally. And until recently, design has also been hampered by the paucity of available Arabic fonts.

For these reasons, you might find Arabic websites or webpages look odd or outdated. But Arabic-specific website design is swiftly catching up. New Arabic typefaces are emerging all the time and designers are achieving stunning visual effects with graphics instead of computer font for non-standard typefaces. And web developers are creating intuitive experiences for Arabic users with existing and emerging digital design technology.

Designing multilingual sites that include Arabic takes careful planning to ensure there’s no design conflict between LTR and RTL. The layout needs to work in both formats, and images need to be specific to each. Your Arabic language webpage should be underpinned by a content management platform that supports out-of-the-box internationalisation and localisation, ready-made translation files and mechanisms to switch site layout from LTR to RTL, while maintaining shared content.

BBC Arabic – common elements of Arabic website design

If you’re developing or enhancing online payment options for UAE (or other Arabic) users, you also need to factor in ‘riba’ (avoiding interest), a key principle of Islamic banking. Credit transactions – and therefore credit cards – are considered haram (forbidden) under sharia law. Across Sharia-based financing, banks have addressed this by issuing pre-paid cash cards or debit cards. While elsewhere in the MENA region, most UAE online purchasers still largely rely on cash on delivery (COD), debit and cash cards are being increasingly used, also facilitating the growth of e-commerce.

UAE websites aim for cultural and brand recognition and ‘clean’, uncluttered message content to attract, inform and guide users. While UAE websites don’t use excessive iconography, hyperlinking and direction-giving to support and direct users as do websites across the Asian region, they do make imaginative use of Arabic calligraphy and the iconic imagery of the region – particularly the Dubai skyline and features of the arid landscape, flora and fauna. Designers employ culturally recognisable, appealing colour schemes to convey trust and purity, incorporating sunny greens and blues with plenty of white background for a clean, pure look.

If you’re doing business in the UAE or one of the other MENA countries, chat with your in-country contacts about their preferred websites and how they use the internet, to give you a more nuanced picture of the varied UAE and broader MENA website landscape. Also get on social media to find out what your UAE counterparts, their colleagues and friends recommend! There are also plenty of other useful websites, like Ystats and eMarketer, which produce regular updates and great visuals on market data, consumer data, revenues and trends.

UAE’s booming digital market is well worth exploring. A little digging will reward your efforts and provide deeply valuable cultural and business insights from a digital lens.

We’d love to hear your comments and questions! To find out how InterMondo can support your communications requirements in an international environment, click here.

*This region is also conceptualised and spelled differently, e.g. WANA (West Asia and North Africa) or, less commonly, NAWA (North Africa-West Asia).